"Pristine Capital Partners was a lifesaver when my shop was experiencing a lull. They quickly provided the funds I needed to stock up on in-demand products. Once business picked up, our sales soared! I'm incredibly grateful for their timely assistance."

Ronald R.

"I own a bakery and needed funds for a better oven to increase our production of cakes and bread. Kevin quickly arranged the financing, and now our bakery is bustling with happy customers enjoying our treats. We're earning more than ever, all thanks to Kevin's prompt assistance."

Kristin W.

"I was struggling with multiple loans draining my business cash flow. Kevin consolidated them into a single, easy loan with lower interest. It's been a huge relief, allowing me to focus on my business without the added stress."

Esther H.

"My business earns most of its revenue seasonally, making it challenging to stock up during slow periods. Pristine Capital Partners fast loans provided the timely support I needed to prepare, leading to my best sales ever."

David R.

"I had an opportunity to buy a large quantity of stock at a great price but needed cash immediately. Pristine Capital Partners provided the loan quickly and without hassle, allowing me to double my inventory and reach more customers. Thanks to their swift action, my business is thriving."

Jane C.

"As a self-employed individual, slow periods can be tough. Pristine Capital Partners provided a loan that helped me through the lean times and even gave me financial management tips. Now, my business is thriving, and I owe a lot of my success to their support."

Theresa W.

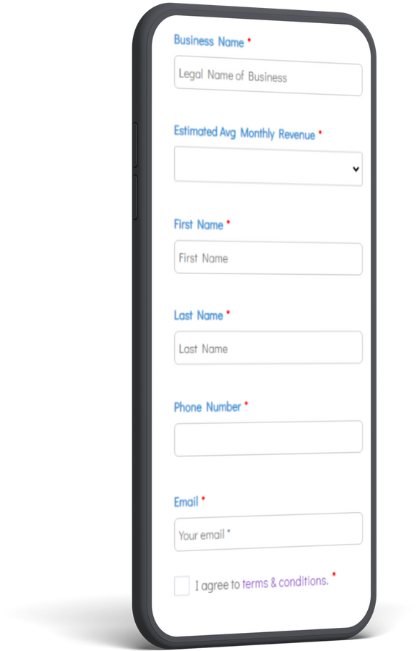

Begin with our state-of-the-art RapidFund Portal™ system. Seamless, private, and dedicated to getting the funds you need — fast. Start here.

Gain clarity and direction as a dedicated account specialist guides you through your business funding options.

With our streamlined process, watch as your business achieves its funding goals. Time for some celebration!

Your passion, persistence, and vision propel your business forward. At Pristine Capital Partners, we ensure financial hurdles don’t slow you down. With our tailored funding solutions, you can stay focused on what matters, while we make the cash flow.

8-12%* 15-18%

2%* 4-6%

1%* a month

Approval amounts up to $5,000,000

In addition to our primary services, we provide comprehensive solutions in invoice financing,

equipment financing, short-term credit, and strategic debt consolidation to optimize your cash flow.

We specialize in a range of funding solutions including lines of credit, term loans, equipment financing, invoice factoring and more to suit your business needs. Our products are designed with flexibility and accessibility in mind.

No, applying with Pristine Capital Partners won’t impact your credit score. Our initial review involves a soft credit inquiry, which is completely credit-friendly and won’t affect your financial health. However, if you decide to proceed with the funding process after the initial review, we may conduct a hard credit pull, which could affect your credit score.

Basic requirements include a minimum period of 1-year in business operation, and at least $10,000 in monthly revenue. We look at the big picture, not just credit scores.

Absolutely. We understand that credit is only one part of your story. We offer solutions that consider your business performance and potential.

There are no hidden fees or unexpected costs. Transparency is key in our process, and all potential fees will be clearly outlined in your funding agreement.

To apply, you’ll need basic business information, recent bank statements, and potentially some additional financial documentation depending on the funding type.

Our application is fast and seamless—complete the online form in minutes. Following a brief conversation with our experts, funding can be provided as soon as the same day, pending underwriting approval.

Rates are competitive and tailored to your business profile and funding needs. Terms are transparent and designed to suit your cash flow.

We’re proud to serve a diverse range of industries. Our team will evaluate your specific situation to provide a custom funding solution, regardless of your business type.

Funding is tailored to your business’s financial health and potential. The amount can vary, but we aim to meet your funding requirements to support your growth objectives. Our ranges can go from $10,000 – $2,000,000.

Your privacy is important to us. We use industry-standard encryption and security protocols to ensure your information is protected throughout the application process.

Get Updates and Stay Connected. Subscribe To Our Newsletter

© 2024 Pristine Capital Partners. All rights reserved. | Privacy – Policy | Terms and Conditions

Powered by Artani